INTRODUCING ASAPP OXP® 22

Delivering enhanced address handling and powerful reporting capabilities to elevate both member and staff experiences.

ASAPP OXP Version 22.0 introduces key enhancements across Origination and Engagement, including improved rural address handling and a robust new reporting infrastructure designed to support Power BI integration. These updates are designed to streamline operations, improve data accuracy, and empower Client-Partners with deeper insights through templated dashboards and customizable reporting tools.

NEW FEATURES - ORIGINATION ENHANCEMENTS

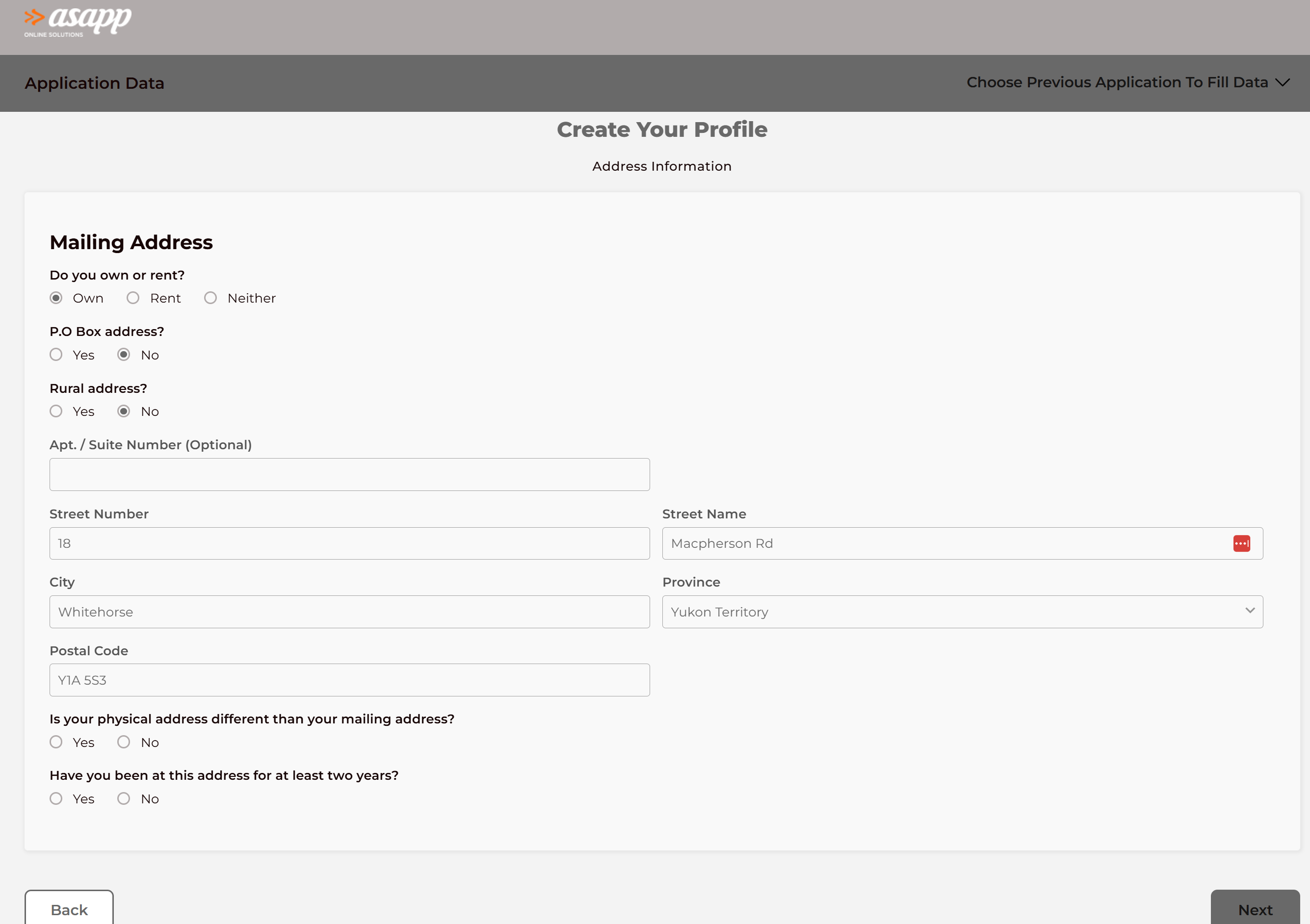

Improved Rural Address Handling with Canada Post

To better support applicants in rural areas, ASAPP OXP now includes enhanced logic for address validation:

• When Canada Post cannot locate an exact match, the system will use the closest available match.

• New validation checks will reject addresses that fall outside the original postal code or province, preventing irrelevant or incorrect data from populating.

• In such cases, applicants will be prompted to manually enter their address, ensuring greater accuracy and user control.

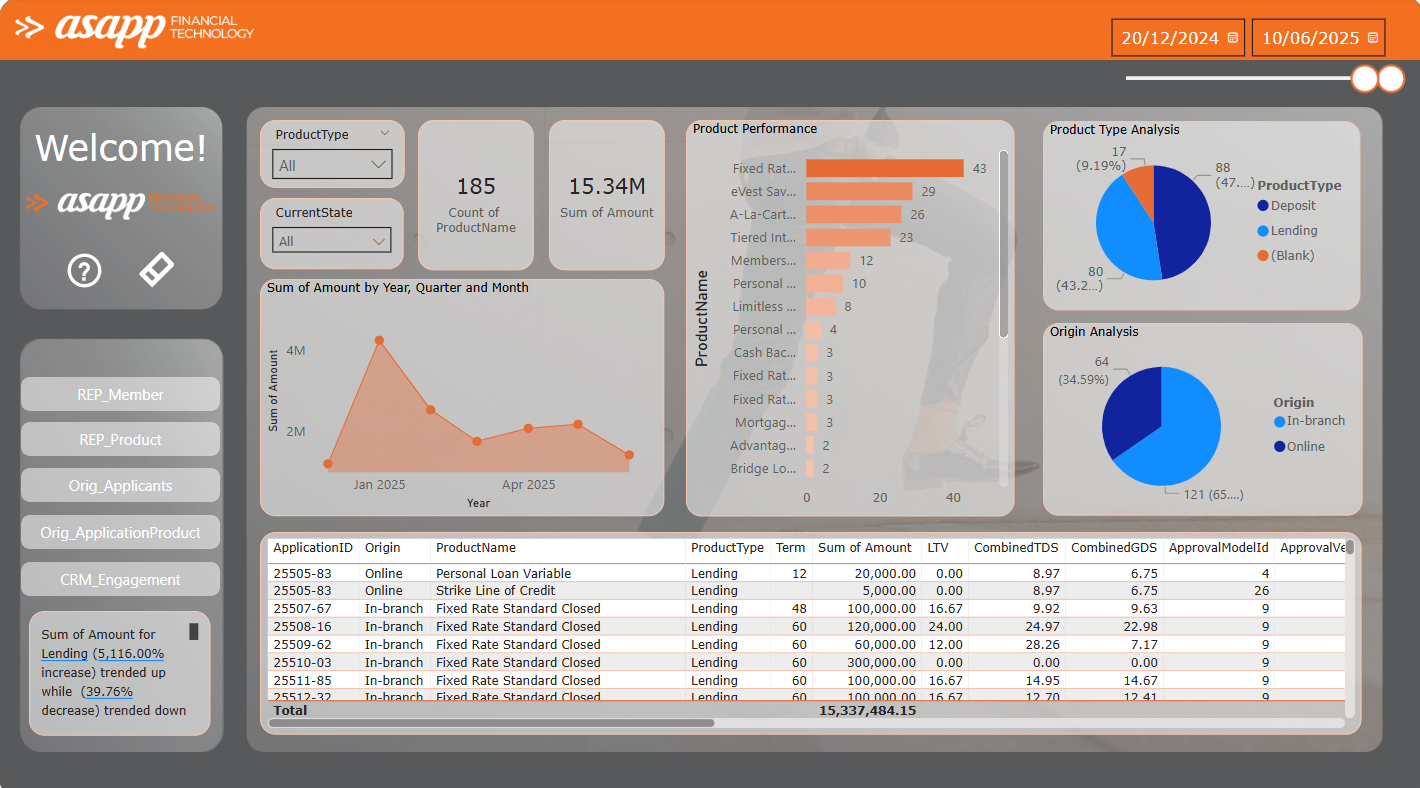

Reporting & Power BI Integration

Dedicated Reporting Database Access

To support advanced reporting needs, ASAPP Financial Technology has introduced nightly-updated, flattened reporting extracts. These are available to Client-Partners via a secure, dedicated Microsoft Azure Data Reporting Service infrastructure. As of now, we have 250+ data points across all tables available for reporting.

ASAPP released a suite of templated Power BI dashboards as part of Version 22.0. These dashboards provide immediate insights using the new reporting schema and can be extended or customized by Client-Partners using their internal Power BI licenses. In the future we will be releasing more data points and additional Power BI dashboard templates for Client-Partners to leverage.

Current Reporting Tables Include:

Member Table – Consolidated member view from Core Banking, Origination, and Engagement (Engagement + Opportunity Engine licensing required). Dashboard includes:

- Account Type Analysis

- Branch Analysis

- Member Geographic Heat Map Analysis

- Credit Score Tier Analysis

- New Member Count Over Time

- A Detailed Table View of the Data

Product Table – Product-level data from Core Banking (Engagement + Opportunity Engine licensing required). Dashboard includes:

- Primary Branch Analysis

- Product Type Analysis

- Product Geographic Heat Map Analysis

- A Detailed Table View of the Products

Applicant Table – Retail Origination data including credit scores and ratios (available to all Client-Partners). Dashboard includes:

- Applicant Income Analysis

- Geographic Analysis

- Member Analysis

- Branch Analysis

- A Detailed Table View of the Applicants

Application Product Table – Application-level product data, status changes, and lending model metrics (available to all Client-Partners). Dashboard includes:

- Total Product Count

- Total Product Amount

- Product Performance

- Product Type Analysis

- In-Branch/Online Analysis

- A Detailed Table View of the Applications

Engagement Table – Consolidated data on conversations, concerns, opportunities, and sales (CRM + Engagement licensing required). Dashboard includes:

- Engagement Type Tree Map Analysis

- Sum of Sales Value Over Time

- A Detailed Table View of the Engagement Types

Business Origination data will be added to the Applicant and Application Product tables in the coming weeks.

ASAPP OXP® 21

The latest of ASAPP OXP is here, version 21. These Roadmap Enhancement have been released including several exciting new features and platform enhancements to the origination and engagement feature sets.

NEW FEATURES - ENGAGEMENT

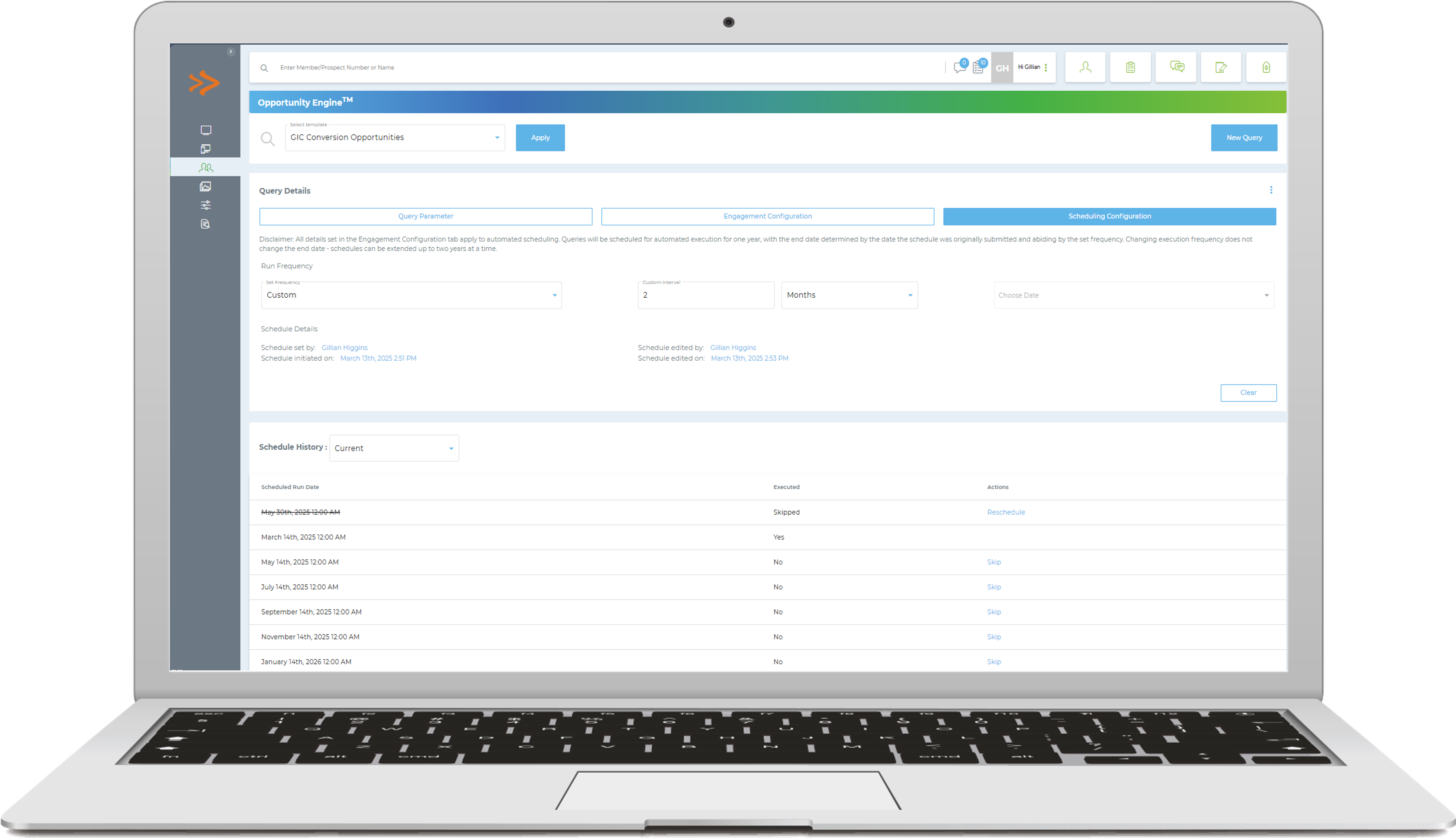

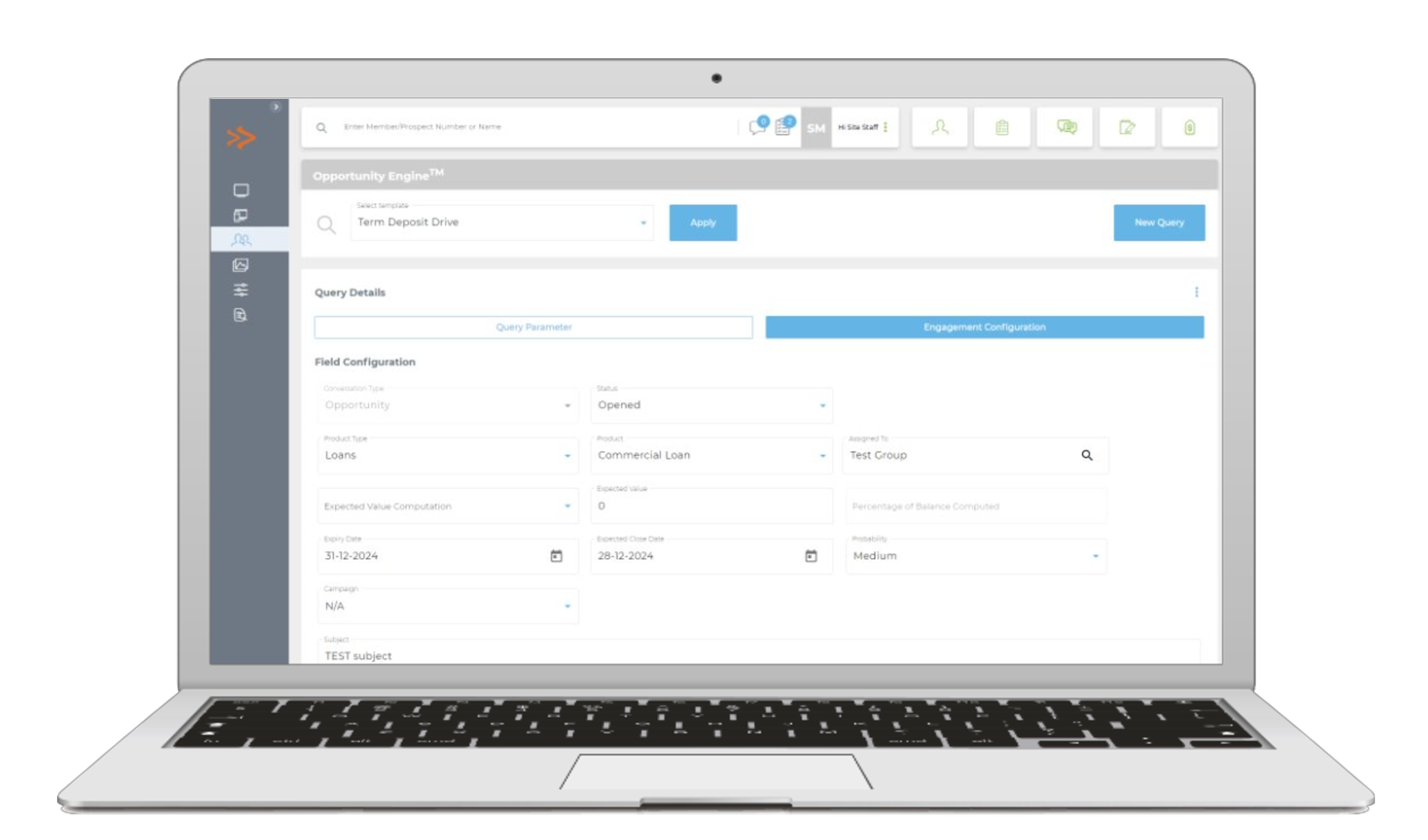

Automating the creation of Conversations, Opportunities or Concerns from Opportunity Engine results

Saved Opportunity Engine templates that have been configured for Engagement can now be scheduled for a daily, weekly or custom frequency execution, for up to two years at a time. Users can skip or reschedule future dated executions, edit the schedule's frequency, extend the scheduling or discard it entirely. On the scheduled dates, the system automatically runs the query against ASAPP's Data Warehouse and generates an Opportunity, Conversation or Concern for the members returned, based on what is configured at the time of execution.

This enhancement marks the final phase of a multi-release initiative to eliminate the existing manual process of running queries and defining the field requirements of each CRM object that needs to be created to expose the data insights across the Team Portal.

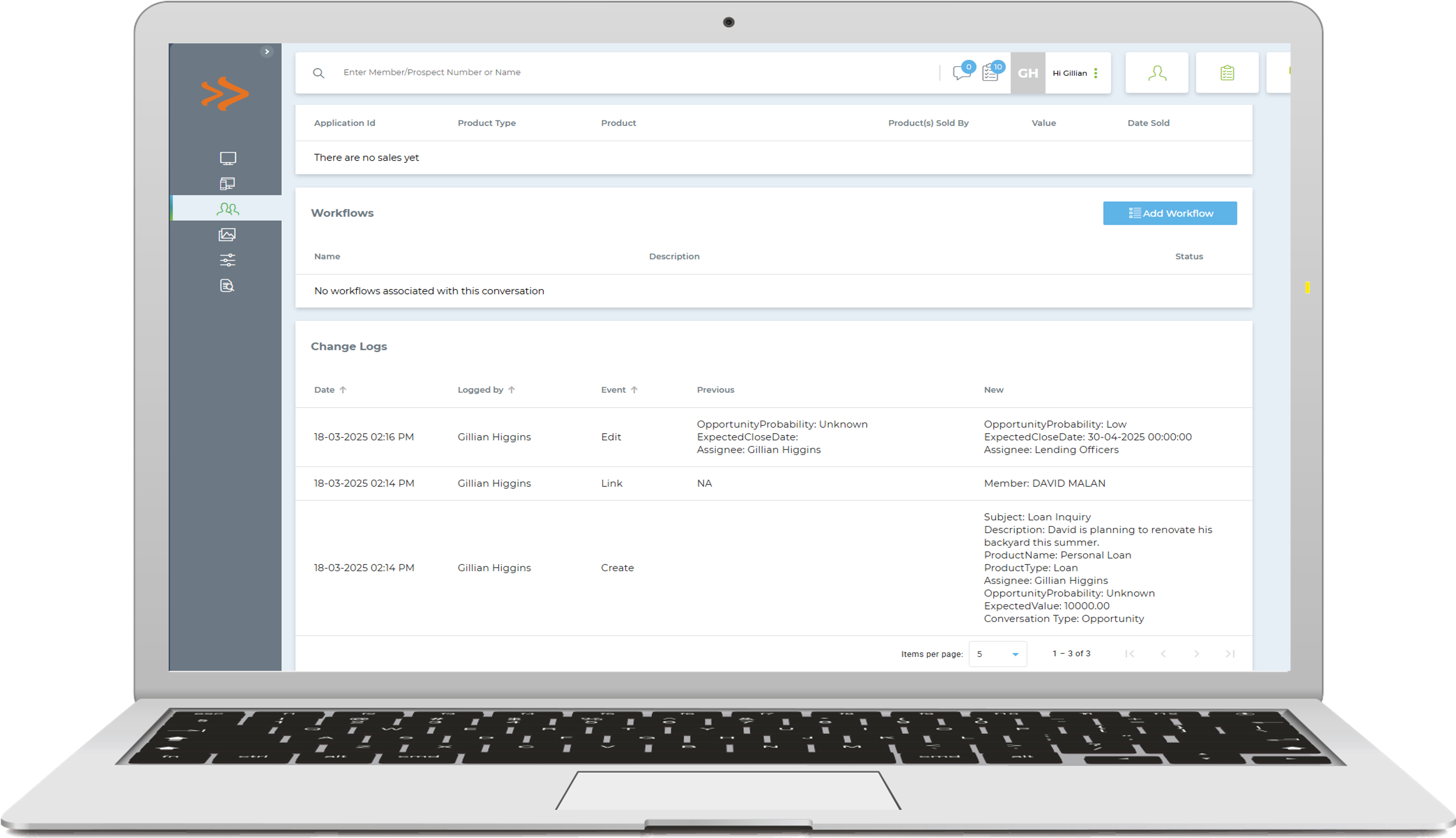

CRM Change Log

Conversations, Opportunities, Concerns, Tasks, Sales, and Interactions now support a Change Log that summarizes changes made to the object over time. The Change Log is broken into key events such as Create and Edit - all events relay the date/time of change, the user who saved it, and the previous vs new value of the field.

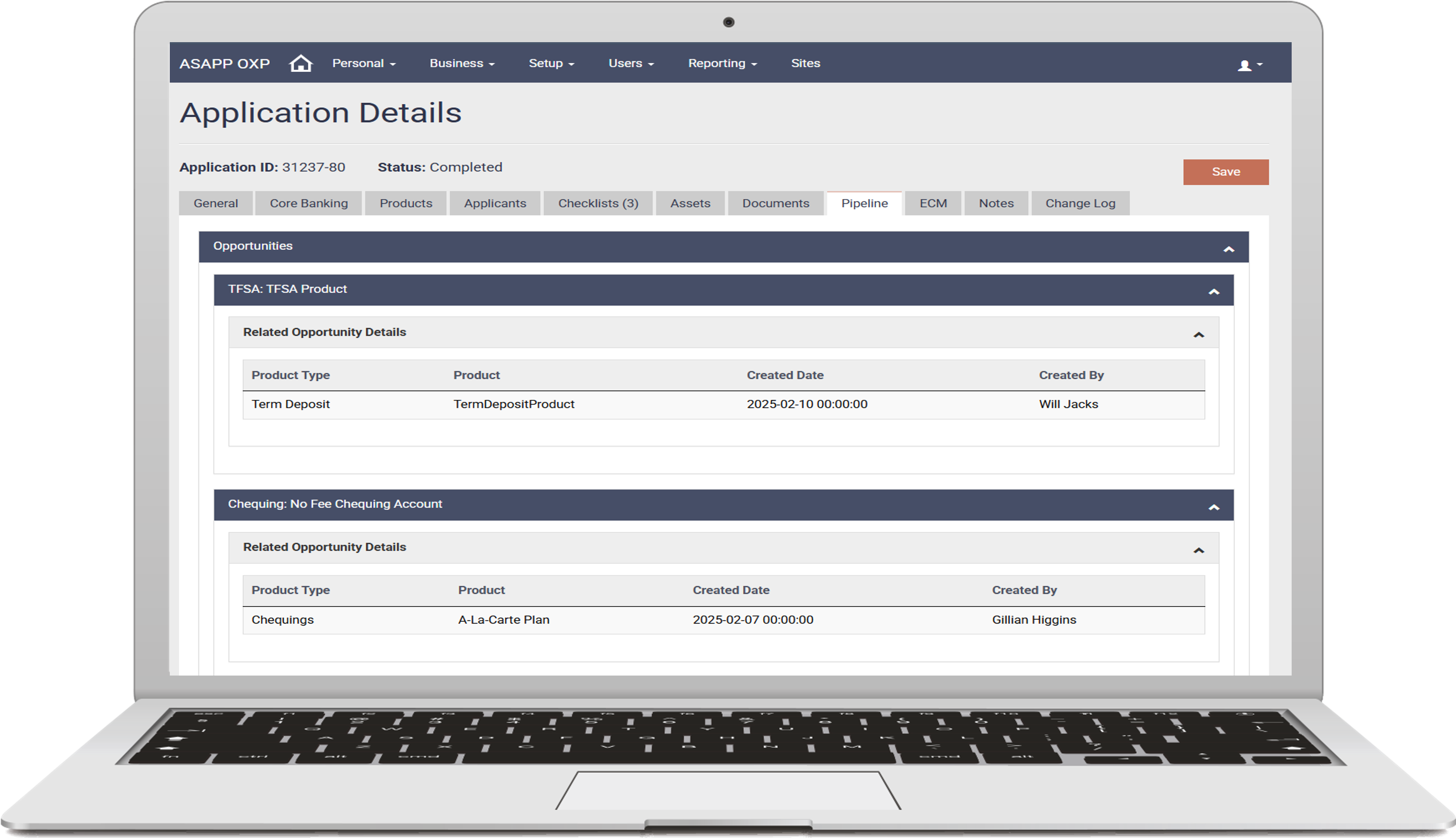

Pipeline Integration between Origination and Engagement

Opportunities can now be generated when viewing an application in the Origination platform. Products now support the configuration of an Opportunity template which is used to drive the field value pairs associated with the Opportunity, though these fields can be adjusted prior to creation. Users also have the option to search for existing Opportunities and associate them to the application instead of creating a new one. This feature reduces the work required by staff to ensure in-flight applications are tracked in Engagement.

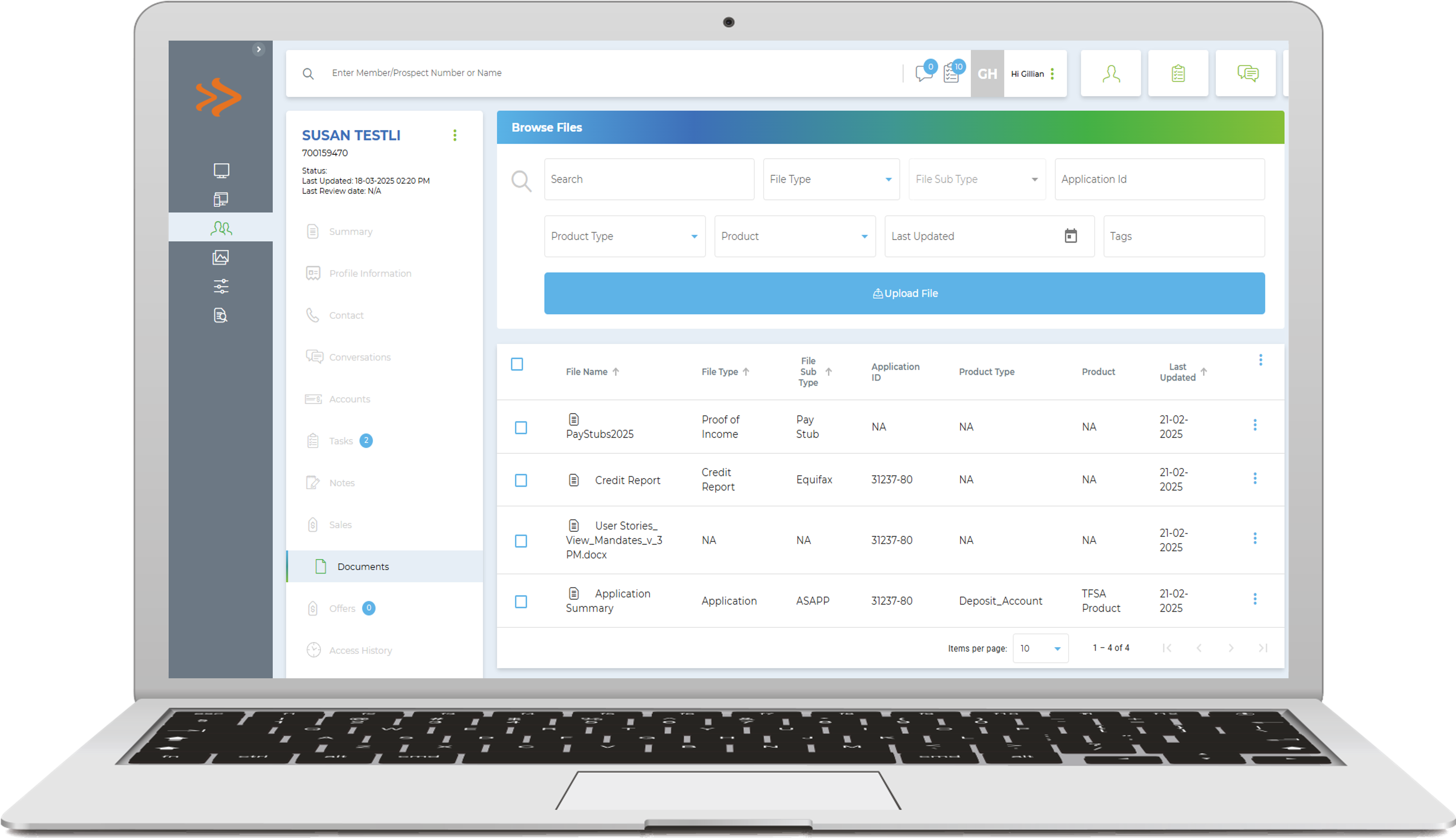

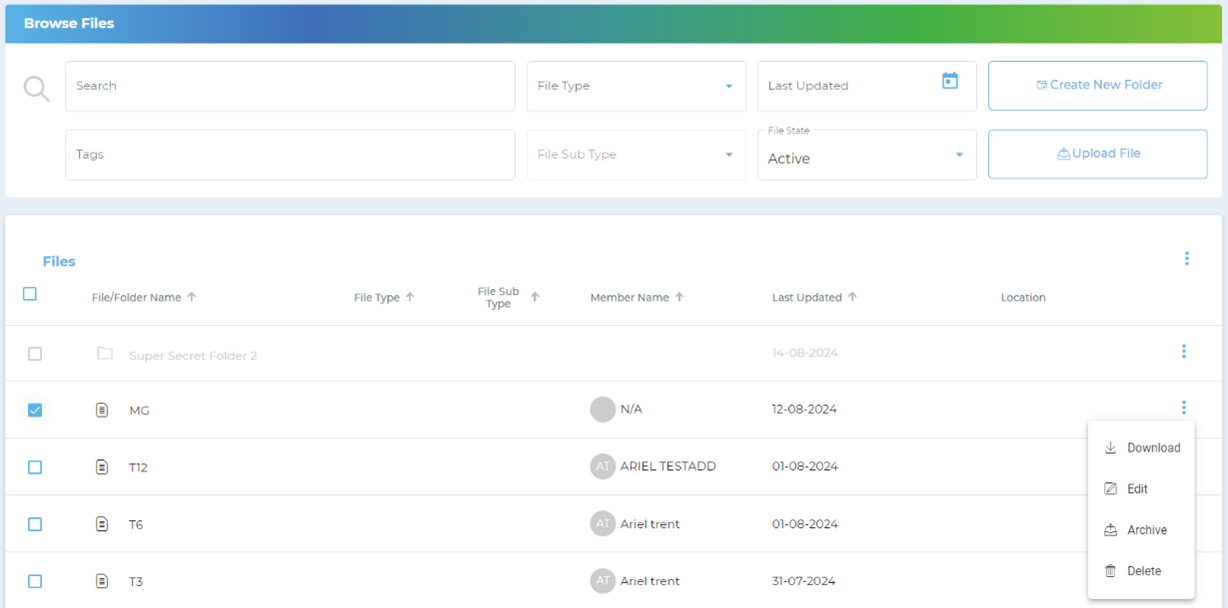

Enhanced File Upload and search capabilities on Member Documents page

To improve the ability for users to locate files that pertain to a particular application, the Member Documents page has been enhanced to display the Product Type, Product and Application ID per file. Filter fields have been added to the page to further expedite a users search for specific files. A new file upload action has been added to the Member Documents page that allows users to upload new files and associate them with existing, synced Application IDs for that member.

Additional Enhancement

Additional Engagement enhancement are included in this release, such as:

- Enhanced Sales integration between Origination and Engagement

- HTML File Support per Email Template

- Additional Email Template merge field

- Dynamic redirect when saving or cancelling and edit or view request

- Display of the Date Assigned field in filter and results grid of key Member Management pages

NEW FEATURES - ORIGINATION

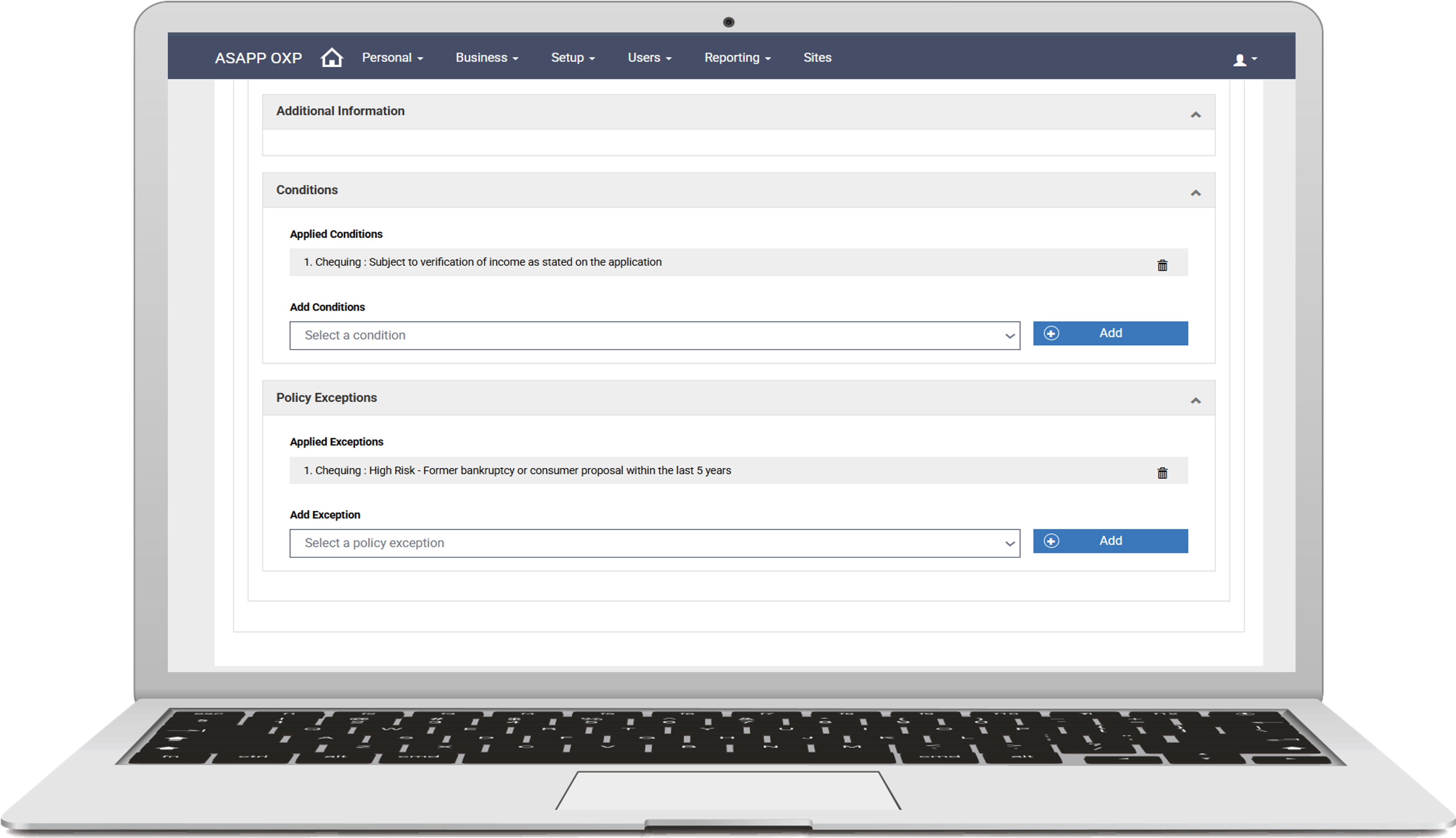

Configuring Condition and Policy Exceptions for Retail and Business Applications

Staff can add Conditions and Policy Exceptions to Retail and Business Lending and Non-Lending Products. These conditions and restrictions are then available on applications, enabling staff to track them and ensure their review and decisioning aligns with the institutions preferences/requirements. Conditions and Policy Exceptions can also be listed on documents via the existing DocuSign labeling process, guaranteeing a transparent member application experience.

Ability to use Separate Equifax Credentials for lending and non-lending products

Credit Unions can provide a separate set of Equifax credentials to allow for soft-hit credit report pulls. Soft hit credentials are used on Retail and Business Deposit, Term Deposit and Chequing (without overdraft) products. Hard hits are always performed for lending products such as Loan, LOC, Mortgage and Overdraft protection.

Additional Enhancements

Additional Origination enhancements are included in the release, such as:

- Ability to update Fees on a business application and have access to those fees through DocuSign Labels.

- Ability to force a rule in the system that requires a checklist to be completed before application can move to verified or completed status.

- Equifax Kount results display formatted response

ASAPP OXP® 20

Engage your members with ASAPP OXP’s latest version

The ASAPP OXP Version 20.0 Roadmap Enhancement release includes several exciting new features and platform enhancements to the origination and engagement feature sets to improve both customer and staff experiences.

NEW FEATURES - ORIGINATION

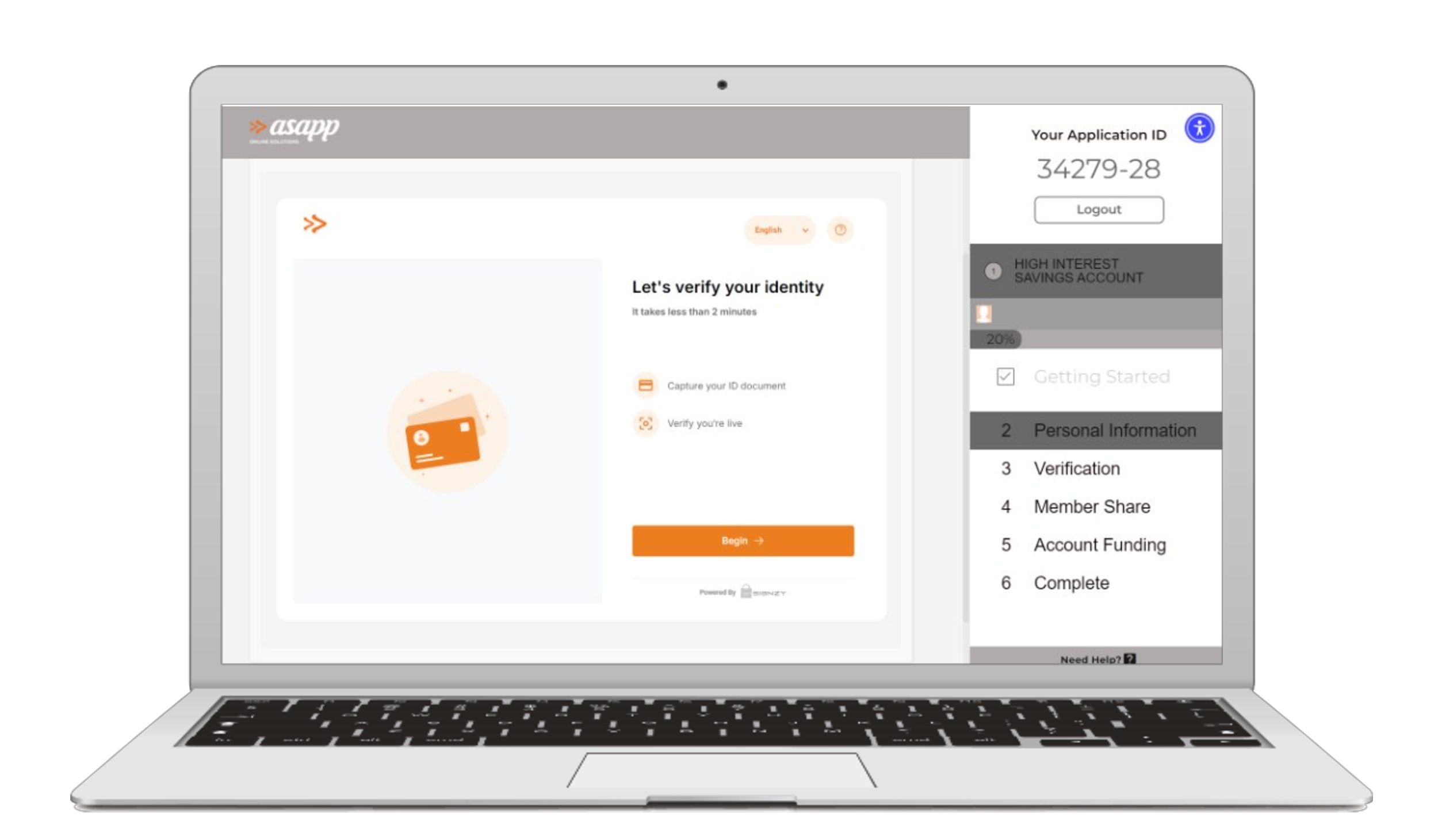

Signzy One Touch KYC Biometric Verification

The Signzy One Touch KYC Biometric Verification capability has been introduced to both the retail and business application journeys.

This includes new page layouts and styling across the entire retail application journey.

The One Touch KYC verification enables a seamless user experience while maintain robust fraud prevention and applicant verification capabilities, including:

- Document intelligence checks to confirm document type based on text and field positioning

- Facial recognition comparing the image from the document against the applicant’s image

- Liveness check to ensure applicant is capturing their image in real-time

- Security checks on the document such as key security features and MRZ review and comparisons

- Data extraction to pre-populate the retail application and robust summaries provided for the staff to review during adjudication

Several configurations are available to determine which flags or triggers may trigger manual review processes in the backend.

Business Biometric Enablement

The business application process has been updated to support the One Touch KYC Biometric Photo Identification capability for applicants verifying their identity online.

Manageable Business Declarations

The declaration collected for businesses or individuals on business origination journeys can now be managed like declarations on retail applications. Financial Institutions can now control the language and behavior as well as identify if a certain declaration is required for certain types of application or individuals.

With this enhancement, the declaration on individual verification flows during business the application have changed in the way they are presented to synchronize with retail declarations. For more information, please review the updated release notes in the Service Desk portal.

Additional Enhancements

Additional origination enhancements have been included as part of this release, including:

- Ability to disable credit report pulls on specific lending journeys

- Enforcement of non-expired ID collection on business journey

- Addition of contact page as persistent navigation item in business journey to improve overall user experience

NEW FEATURES – ENGAGEMENT

Automating the creation of Conversations, Opportunities or Concerns from ASAPP OXP Opportunity Engine™ results

Saved Opportunity Engine templates can now be configured for Opportunities, Conversations or Concerns. In a single-click, users can generate the configured CRM object for each member returned in the query – any Workflows or Templates listed in the configuration will be linked to the object, ensuring the follow-ups performed by assignees align with the Credit Union’s best practices.

This enhancement is Phase 1 of a multi-release initiative to eliminate the existing manual process of running queries and defining the field requirements of each CRM object that needs to be created to expose the data insights across the Team Portal. Automated scheduled execution of these capabilities will be included as part of Version 21.0.

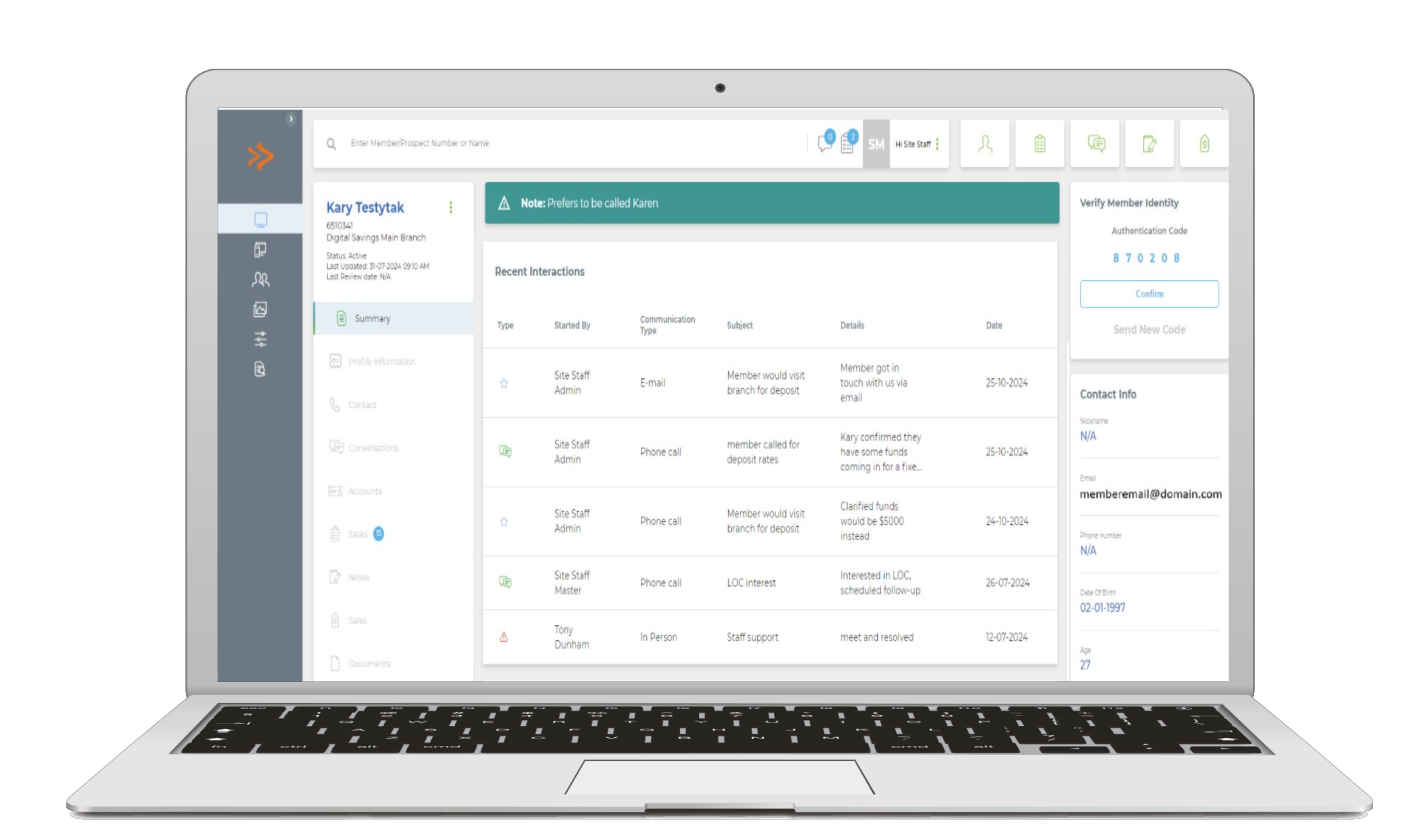

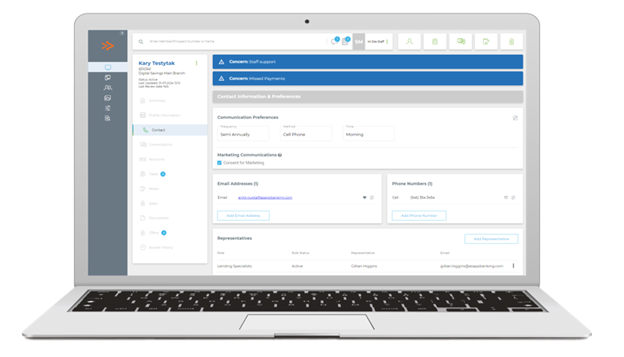

Member Authentication via Email or SMS

Staff members can now push a randomized, 6-digit code to a member’s preferred email address or cell phone. When the member reads out the code, the CU representative can confirm the verification, and the system will record a Member Authentication event in the member profile’s Access History page, establishing an audit trail of identify validation. This feature aligns with the verification flows offered by several of the Big 5 Financial Institutions.

Time Zone Configuration and Timestamp Conversion

To improve the ability for staff to understand the exact time that certain actions took place, Client Partners can now identify their preferred time zone. This setting is at the Credit Union level, meaning that all staff supporting the CU share the same time zone. Fields that display timestamp data are automatically converted to the Credit Union’s preferred time zone.

Additional Enhancements

Additional engagement enhancements have been included as part of this release, including:

- SMS template support and delivery via Twilio integration

- Improved link inheritance and visibility across the portal

- New date field operators to support the re-execution of timebound queries in Opportunity Engine™

- Expansion of the Householding feature to Business and Prospective members

The ASAPP OXP Version 20.0 Roadmap Enhancement includes a broad set of new capabilities introduced across the platform based on Client-Partner feedback and showcases our continued commitment to bringing innovative capabilities to our Client-Partners and their customers.

ASAPP OXP® 19

The ASAPP OXP Version 19.0 Roadmap Enhancement release includes several exciting new features and platform enhancements to the origination and engagement feature sets to improve both customer and staff experiences.

NEW FEATURES - ORIGINATION

Support For New Business Types

The business application now supports the addition of sub-types, configurable in the backend administrator portal. When enabled, applicants can select their business sub-type on the business application landing page prior to product selection.

Business sub-types can be used to target specific product offerings, tailor document upload requirements, as well as configure specific forms for filling and digital signature.

FHSA Account Type Support

Support for First Home Saving Accounts has been added to the retail application process. When configured, applicants can apply for FHSA accounts and the appropriate plan types are issued to core banking during committal.

Additional Improvements

Several other smaller improvements have been included, such as:

• Change tracking has been added to personal configuration, business configuration, and site configuration sections in the backend and will retain a history of any changes performed in these areas.

• Add applicant functionality in the application details has been extended to allow ID uploads.

• Lending summaries are now included in the printable/downloadable application view.

• Content bocks have been re-organized in the backend to facilitate content management.

NEW FEAUTURES - ENGAGEMENT

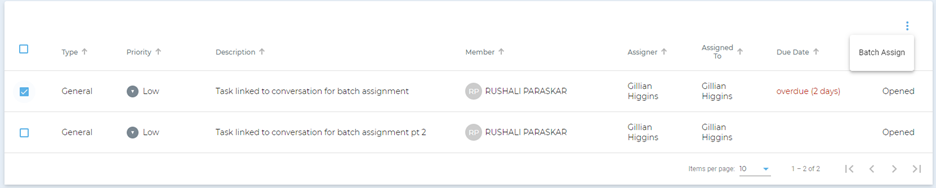

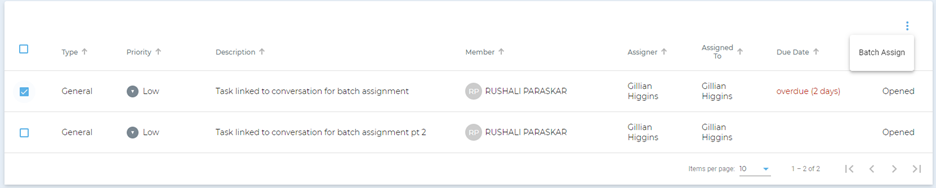

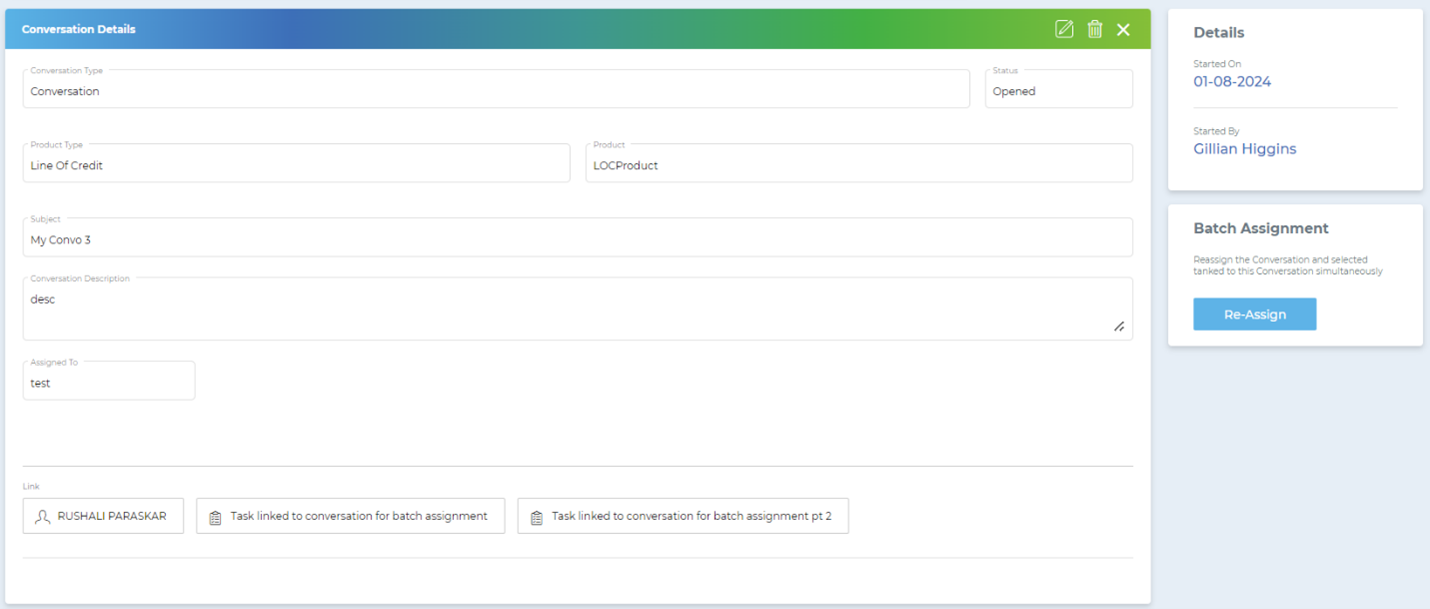

Batch Assignment

To ensure that a Conversation and its linked items can be reassigned in bulk, a Batch Assign function has also been added to the Conversation, Opportunity and Concern details page.

Modal Movement and Minimization

View and Create modals for all CRM objects (Conversations, Opportunities, Conversations, Concerns, Notes and Sales) can now be dragged around the screen to reveal underlying information. If a user needs to access information on a different page, these same modals can be collapsed into the site's left navigation and menu using a new minimize action, after which they can navigate throughout the site.

Collapsed objects retain all previously entered data and can be maximized by selecting the collapsed icon.

ECM File Archiving, Restoration

To support the maintenance of files, the ECM module now supports the ability to archive and restore files. Archived files are no longer visible from linked objects or member profiles. These files can be restored, in which case all previous links are reinstated, and the file is once again accessible from these links.

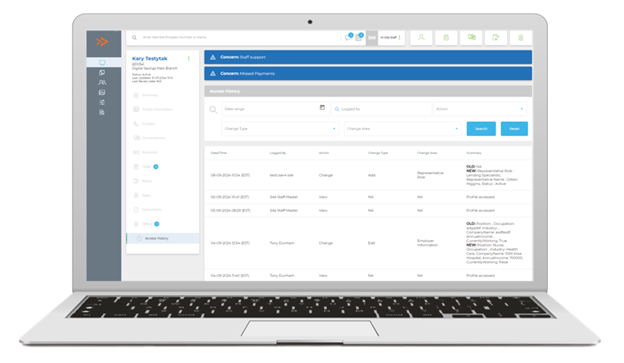

Access History

An Access History page has been added to member and prospect profiles (retail and business) that identifies when and by whom a profile has been viewed.

The page also summarizes changes made to the member's/prospect's information across the Summary, Information and Contact pages, including when it was changed, who submitted it, and what piece of data was edited, added or deleted.

Member Representative Roles

When Credit Union staff are the primary point of contact for a given member, they can use the Member Representatives feature to link themselves to the member’s profile.

Representative Roles are a new type of User Group. If an item should be actioned by a specific role, users can list the Representative Role User Group as the Assignee, and the system will first look to see if a user is listed for that member under the role. If one is found, the item will be assigned to that individual; if one is not found, the item will be assigned to the group.

Additional Improvements

Several other smaller improvements have been included, such as:

• If the Task notification feature is enabled for Users or User Groups, and a task is added to a Conversation, Opportunity or Concern either during the create or edit event for these parent items, the system will now send a notification email advising of the Task’s assignment.

• When creating a new CRM object, if information has been entered in any field and the user hits the ‘x' icon in the modal’s top right corner the system will display a confirmation message about the cancellation. This advises the user that all data will be discarded and helps prevent unnecessary loss of data should the user have selected the 'x' by accident.

• The Opportunity, Conversation and Concern importing procedure has been optimized to improve processing time of high-volume imports.

The ASAPP OXP Version 19.0 Roadmap Enhancement includes a broad set of new capabilities introduced across the platform based on Client-Partner feedback and showcases our continued commitment to bringing innovative capabilities to our Client-Partners and their customers.